The Investment Advisor’s Perspective on Common ESG Investment Mistakes

It’s hard to invest intelligently while simultaneously adhering to your values. When navigating this landscape we often have to choose between the benefits of a well-diversified portfolio and the commitment to environmental awareness. How well do ESG mandates capture environmental considerations? What funds are guilty of “green washing”—doing the minimum to market a green approach while still placing property with polluters. We have the answer. By running some of the most popular funds through our carbon screener, we found some surprising results that fall into three broad categories. The funds we chose are emblematic examples of larger trends across many fund families.

Investing in a “Low Carbon” Fund to Minimize Carbon Emissions

Funds that name themselves low carbon teach us that the use of the low carbon moniker has nothing to do with whether they are actually omitting carbon from their allocation effectively.

Many investors will choose funds labeled as “low carbon” to invest in, hoping to reduce their carbon footprint. Not all funds are labeled as accurately as investors would think.

For example, take the iShares Low-Carbon Target ETF; this “low carbon” labeled fund doesn’t actually practice any divestment. Since maintaining diversification is a goal of the fund, it will always hold some companies in fossil fuel sectors. To achieve diversification, the fund tracks the MSCI Target Index which takes a standard global index of stocks and re-weights them according to their emissions & fossil fuel reserves. This means the fund isn’t really divesting, just changing how much weight is being placed on fossil fuel investments within the fund. This method of reshuffling also means investors have no say over the weights placed on certain fossil fuel industries, this decision is left up to the fund manager.

Based on the fund name—iShares Low-Carbon Target ETF—investors expect the low carbon fund to focus on lowering investments in fossil fuel industries or for some divestment within the fund. This is essentially what the investment objective for the fund says as well; hoping to have a lower carbon exposure compared to the broader market.1 When carbon screening the iShares Low Carbon ETF we find that the fund has a higher carbon exposure rate than another iShares fund. This “low carbon” iShares fund has a higher exposure rate of 6.24% of assets in fossil fuel companies2 than the iShares 400 Social ETF, which has an exposure rate of 5.03%.3 This is still lower than the S&P 500’s exposure rate of 8.96%.4 iShares somewhat follows through with their objective for the low carbon target fund by having less asset exposure than the S&P 500. However, they cannot produce a better carbon score for their “low carbon” fund than another one of their own funds; how can they compete with the broader market if they cannot compete with themselves?

The iShares low carbon ETF is just one example of how the naming of funds can confuse investors; as investors we all need to take a closer look into the funds we use and be sure they align with our values. Camelotta Advisors provides tools for investors to know the truth about their funds and gives clients the basic right of investing in their values.

- https://www.ishares.com/us/products/271054/ishares-msci-acwi-low-carbon-target-etf

- https://fossilfreefunds.org/fund/ishares-msci-acwi-low-carbon-target-etf/CRBN/fossil-fuel-investments/FS0000B65I/F00000UIVU

- https://fossilfreefunds.org/fund/ishares-msci-kld-400-social-etf/DSI/fossil-fuel-investments/FSUSA07KX3/FOUSA05XNZ

- https://fossilfreefunds.org/fund/spdr-sp-500-etf-trust/SPY/fossil-fuel-investments/FSUSA00B4A/FEUSA00001

Taking an Index and Subtracting the Bad

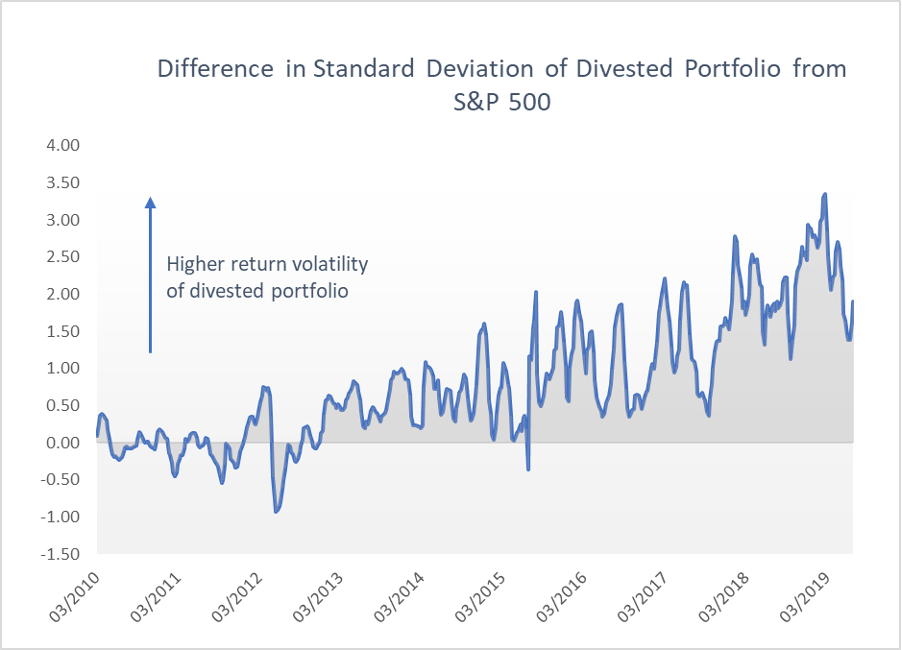

Figure 1, fully divested portfolios can be highly volatile. Data from the IMF

The S&P 500 Fossil Fuel Reserves Free ETF (SPYX) is one of the more popular ESG investments that investors turn to. The fund begins with the S&P 500 and subtracts carbon; this is what we call subtractive divestment. This sounds great to the investor: start with a well-performing index like the S&P 500, subtract fossil fuels, and that will leave you with a somewhat diversified portfolio that is aligned with your values. Many investors see no problem with this strategy and think it will help them achieve investing with their values. While this is one method of divesting, it may not be the most efficient for value-based investing because there is a tradeoff between clean divestment and diversification.

The SPDR S&P Fossil Fuel Reserves Free ETF divests from fossil fuel firms – but only those that own fossil fuel reserves. Yet there are plenty of companies in the business of putting CO2 into the atmosphere that hold no reserves themselves such as Halliburton, Schlumberger, and Marathon. These companies contribute to emissions without holding reserves, by burning fossil fuels that come from reserves.

Since the number of firms is smaller than a non-divested portfolio, the remaining firms each have a slightly higher weight than in a non-divested fund, including those engaged in the fossil fuel business. As a result, these funds are basically divesting from companies like Exxon—which extract oil—and increasing their stake in companies like Halliburton—which sell services and equipment to those companies.

As an investor in the fund, you have no control over the trade-off between diversification and social impact, or how your fund manager decides what gets defined as a fossil fuel. The S&P 500 Fossil Fuel Reserves Free ETF holds a duel mandate of clean divestment and matching the S&P 500. In order to execute both, they limit the definition of what counts as a fossil fuel—allocating less to the energy sector and more to the utilities sector—so they can remain diversified. Allocating assets in the utilities sector is just as bad as holding assets in the energy sector. The Utilities Select Sector SPDR Fund—including securities in the electric, water, gas, and multi-utilities industry as well as independent power and renewable electricity producers1—has an exposure rate of 97.15% of assets allocated in fossil fuels,2 which means divestment from just the energy sector does not fully divest your portfolio. Some fund managers do not include the utilities sector in their divestment because it helps to maintain diversification; thus, investors remain invested in certain sectors of fossil fuels.

For the S&P 500 Fossil Fuel Reserves Free fund to mimic the performance of the S&P 500, it cannot simply eliminate all fossil fuel exposure from the fund without jeopardizing the diversification and creating more volatility (Figure 1). Therefore, we see a readjustment of types of fossil fuel holdings, rather than a full divestment. This explains why the S&P 500 Fossil Fuel Reserves Free fund has more fossil fuel holdings in the utilities sector than the energy sector.3 Compare that with the S&P 500, which has more fossil fuel holdings in the energy sector than the utilities sector.4

The subtractive divestment approach taken in the S&P 500 Fossil Fuel Reserves Free fund does not help investors get any closer to investing in their values. This approach may work for some investors but those looking for full divestment may fall short due to the tradeoff with diversification. At Camelotta we believe in the 3 Rs approach to divestment. This approach allows investors to fully divest, while keeping performance intact. We go beyond subtractive divestment to provide a more holistic approach to investing in your values.

- https://www.morningstar.com/etfs/arcx/xlu/analysis

- https://fossilfreefunds.org/fund/utilities-select-sector-spdr-fund/XLU/fossil-fuel-investments/FSUSA00B4N/FEUSA0000D

- https://fossilfreefunds.org/fund/spdr-sp-500-fossil-fuel-reserves-free-etf/SPYX/fossil-fuel-investments/FS0000C3K4/F00000WAP7

- https://fossilfreefunds.org/fund/spdr-sp-500-etf-trust/SPY/fossil-fuel-investments/FSUSA00B4A/FEUSA00001

Paying Extra to Invest in Your Values

The other way to build a divested portfolio is to hire an active manager who can build a portfolio from the ground-up. With the Parnassus core equity fund (PRBLX), you may feel like you are getting the investing with your values concept 100% right. The Parnassus Core Equity fund has no holdings in any fossil fuel industries.1 This fund has also performed close to the S&P 500 in the past; it must be the one.

Historically, actively managed funds like this one tend to under-perform and over-charge the investor. Over the last 5 years, Parnassus under-performed compared to the S&P 500: the annualized 5 year return as of January 31, 2020 for PRBLX was 11.58% compared to 12.37% for the S&P 500,2 despite the fact that over this time period the fossil fuel-heavy energy sector delivered annualized returns of -30%. Even though Parnassus avoided investing in the worst-performing sector in the S&P 500, it delivered sub-par returns. Parnassus removed the worst performing sectors—energy and utilities—so we would expect them to outperform the S&P 500 by 2.65% per year,3 instead the fund is under performing.

It is notoriously difficult for active managers to meet let alone exceed the performance of a broad market index. Each year, about two-thirds of active managers fail to match their own benchmark, let alone exceed it. In 5 of the 10 years 2010 - 2019, the Parnassus fund has under-performed the S&P 500. Selecting an actively-managed fund introduces an extra layer of management risk – the risk that you select a poor manager – that has historically not added value to your portfolio.

Finally, all that time spent finding stocks with good environmental records has a cost – and you pay it in the form of higher fees. Parnassus Core Equity Fund Investor class shares have a net expense ratio of 0.87%.4 While the S&P 500 Fossil Fuel Reserves Free fund5 and the iShares Low Carbon Target fund have net expense ratios of 0.20%,6 since they are passively-managed index funds.

Despite the stupendous inflows of assets into ESG, low carbon, & socially conscious funds, it remains tricky for an individual to divest by buying a single fund without sacrifice, paying higher fees and getting lower returns. That’s why we at Camelotta Advisors built Large Cardinal – which leverages low-cost index ETFs to build a diverse portfolio with exposure to the economic factors that drive fossil fuel returns, without the carbon.

- https://fossilfreefunds.org/fund/parnassus-core-equity-fund/PRBLX/fossil-fuel-investments/FSUSA001WD/FOUSA00ECB

- https://www.parnassus.com/parnassus-mutual-funds/core-equity/investor-shares#performance

- Based on S&P 500 Sector weights as of February 2019. Utilities weighted 2.82% and Energy weighted 6.02% with both sectors weighting 8.84%. To get outperformance: (0.30) (0.0884) = 0.02652 or 2.652%

- As of January 31,2020. https://www.morningstar.com/funds/xnas/prblx/price

- As of October 31, 2019. https://www.morningstar.com/etfs/arcx/spyx/price

- As of November 29, 2019. https://www.morningstar.com/etfs/arcx/crbn/price

About Camelotta Advisors

Becoming rich is not about doing a million different things. It’s about focusing on a few things and doing them right. For almost 20 years we have helped successful people accomplish sustained wealth. Based in San Francisco and Seattle, we are a fiduciary working with a small number of select clients delivering highly tailored professional financial planning and portfolio management.

Get in Touch

You can send us an email or schedule a phone call with your team by using the calendar provided here.

Disclaimer: Camelotta Advisors is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Camelotta Advisors and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Camelotta Advisors unless a client service agreement is in place.

Copyright 2020 Camelotta Advisors. May not be reproduced without permission.