Investor Commentary Q1 2021

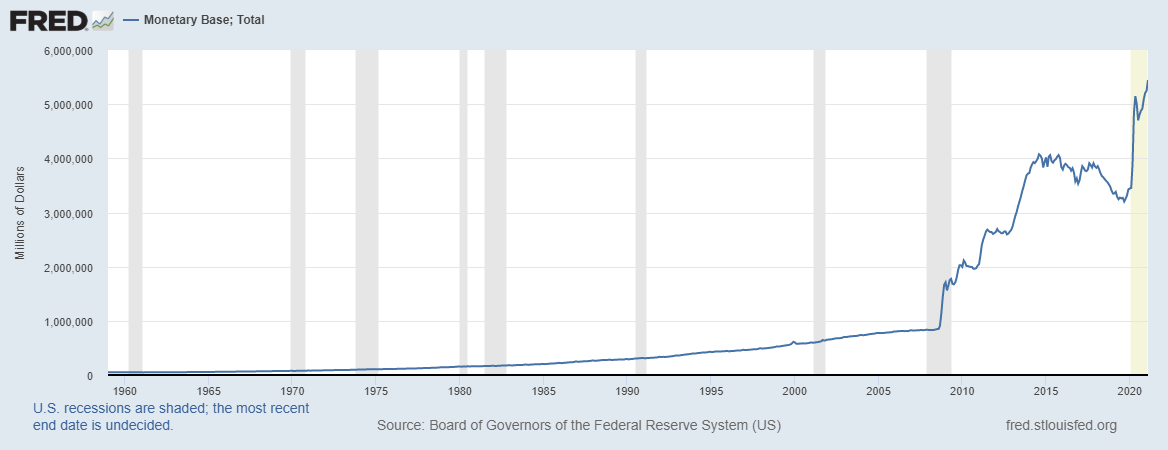

Springtime brought investors a blossoming US economy accelerated by massive government stimulus. Such rapid growth is largely attributable to a resumption of demand as vaccine rollouts take effect and Americans resume travelling, working, and other activities outside of their homes. But it is also a consequence of the massive amount of government payments to businesses and individuals, mostly funded by debt which becomes, in essence, printed money. The amount of money in the US economy grew from $3.2 trillion in July ‘19 to $5.45 trillion today which is growth of 69%. Placed in historical context, we can see that this is far more money and growth in money than we have ever seen in our lifetimes.

What do we make of such rapid monetary expansion? Shouldn’t that be inflationary? Recall that inflation is a monetary phenomenon where the money supply is in a horse race with economic growth. As the economy expands, so should the money supply. Isn’t it inflationary to address last quarter’s GDP growth of 7% with a tenfold sized boost in the money supply? The answer is yes but there are four deflators that will delay the onset of any inflationary forces:

Capacity of the Economy

Generally, you wouldn’t expect prices to rise until supplies run out. But after Covid-19, the productive and consumptive infrastructure of the economy remains intact. Normally in a recession, these things are destroyed. Sure, your corner restaurant is closed but ultimately most business can rebound rather quickly in the presence of good entrepreneurs well-capitalized. I would argue that there has never been a better time to open a new B2B or B2C firm.

Global Economics

We live in a global economy. If you look at the dollar, it has started to strengthen which is disinflationary, especially in an open economy that imports 10% of its GDP. Therefore, the inflation outcome is possible, but a lot has to happen for it to come into being.

Money Multiplier

Simply put, when a new dollar is formed, it gets saved and spent numerous times. The exact number of times is called the “money multiplier” and is often described as the velocity of money. While the full effects of the pandemic were raging, the velocity of money dropped. Put another way, we have never seen more money stocked away in savings accounts in America. As this velocity rises, money expands rapidly. However, until it expands enough to consume the excess capacity plus the growth in the economy, it is not inflationary. I covered this in my last letter when I deflated investment returns using the velocity and monetary base.

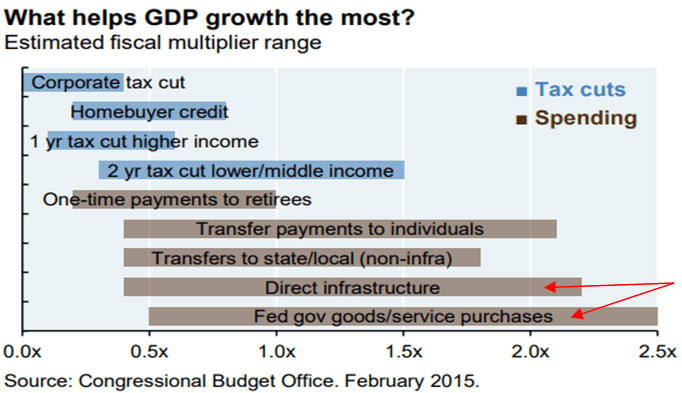

President Biden has a very specific plan to increase American infrastructure. This is beyond the usual defense department spending and gets into rebuilding the energy infrastructure, enabling more people to realize their potential in the workforce, and rebuilding roads and bridges. This type of spending has its own multiple in terms of building GDP and accordingly is a bulwark against rising inflation. Therefore, the inflation outcome is possible, but a lot has to happen for it to come into being.

We believe that GDP growth will be very real and rapid—at least in the near-term—which will absorb a lot of the excess money. Combining that with the fact that monetary velocity has declined, I don’t expect to see near term inflation.

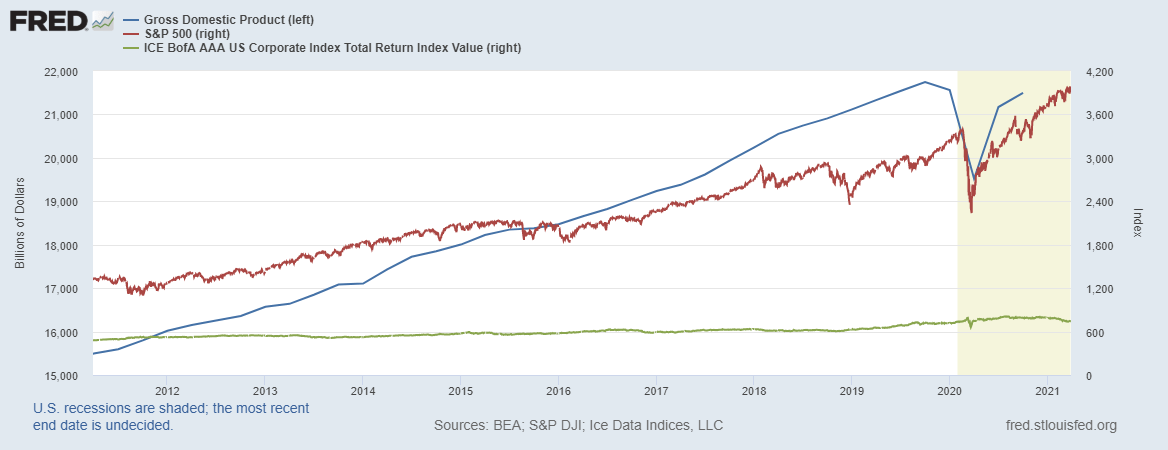

It is easy to be fooled into thinking this is the beginning of an expansion given economic repression of the past year but viewed against the big picture, we are entering a classic later phase expansion. As you can see below, the current expansion began around 2010 and is the second longest economic expansion in American history. Against this backdrop, the Covid-19 recession, looks to be a mere waystation along the road to a much larger economy.

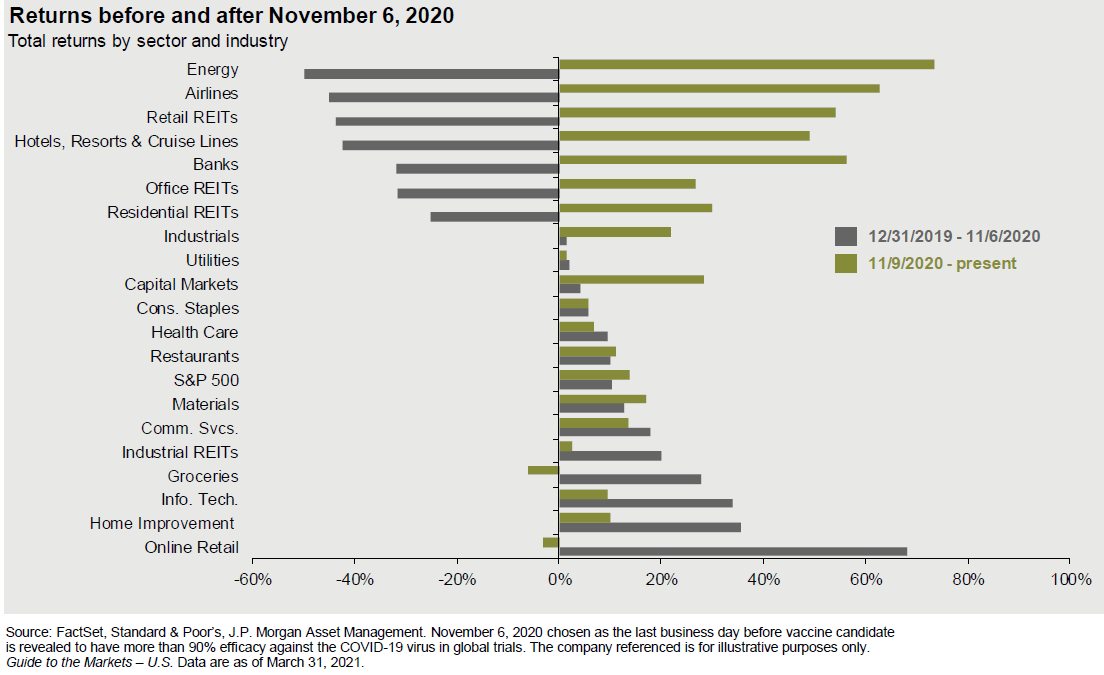

Consistent with a later stage expansion was a farewell to former market leaders and a greeting of a new set of drivers. Recall the incumbent—the technology sector—delivered the only sustainable growth story during the pandemic and before that, exiting the 2008 financial crisis. Accordingly, technology firms drew huge amounts of capital: so much that the five most valuable firms in the S&P 500 (Microsoft, Apple, Facebook, Alphabet, and Amazon) enjoy more investor money than the bottom 363 companies.

All of a sudden, technology has faded relative to some other sectors—we can see in the graph below that early expansionary businesses are giving way to more economically sensitive lines like energy, financials, and industrials. These lines of business are the bellwethers of solid GDP growth. Simply put, if the economy is growing, there’s more movement (energy), more moving (construction and housing), and more demand for loans to do both (financials). Adding to this is the fact that the government stimulus is shifting towards spending more than it ever has on infrastructure.

Interest rates govern the values of all investable assets within and outside of markets. Last quarter was notable, for the first time since 1981 we saw Treasury yields increase more rapidly than before. The size of the move is, however, less important than the direction relative to the stock market. This is the first time since the Global Economic Crisis of 2008 (GEC) that a rise in yields did not lead to a selloff in the stock market—formerly, in the era of quantitative easing, we have been in a situation where the market rallied on bad news because it meant lower interest rates. Not any longer.

This quarter’s rally was more in line with longer term historical precedent where rising rates (recall this counterintuitively means falling prices for bonds), led to a risk market rally. It makes sense, if we think of interest rates as the price of money and rates are rising (e.g. real, not nominal, rates) due to more demand for money, then we can conclude that economic activity is rising which is good for business. Therefore, rising interest rates live alongside rising stocks.

This historically significant shift in correlations matters because it creates a healthier environment for asset allocation. Lower correlations—even when some assets go down—help investors lose less in declining markets than they make in rising markets. In other words, for a flat return, the dollar return should theoretically be higher than before.

Copyright 2021 Camelotta Advisors, All Rights Reserved. The commentary on this website reflects the personal opinions, viewpoints and analyses of the Camelotta Advisors employees providing such comments, and should not be regarded as a description of advisory services provided by Camelotta Advisors or performance returns of any Camelotta Advisors Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Camelotta Advisors manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Get in Touch

You can send us an email or schedule a phone call with your team by using the calendar provided here.

Camelotta Advisors is a Registered Investment Adviser. Advisory services are only offered to clients or prospective clients where Camelotta Advisors and its representatives are properly licensed or exempt from licensure. This website is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Camelotta Advisors unless a client service agreement is in place.